In the ever-evolving world of cryptocurrency, where fortunes can pivot on the slightest market shift, the Mining Profitability Calculator emerges as an indispensable tool for enthusiasts and professionals alike. This innovative calculator doesn’t just crunch numbers; it illuminates the path to financial prudence in an arena dominated by Bitcoin’s relentless fluctuations. Picture this: you’re invested in high-end mining machines, perhaps from a reputable seller specializing in robust hardware, and suddenly, Bitcoin’s network difficulty spikes. Without a reliable calculator, your budget could spiral into chaos. By integrating real-time data on miner prices and mining difficulty, this tool empowers users to forecast potential returns, making it essential for anyone dabbling in Bitcoin, Ethereum, or even the whimsical Dogecoin. It’s not merely about mining; it’s about strategic hosting and smart investments in a decentralized economy.

As Bitcoin continues to captivate the global stage, its miner prices often dance to the rhythm of market demand and technological advancements. A top-tier Bitcoin miner, for instance, might cost thousands, but is that expense justified when network difficulty escalates? Enter the Mining Profitability Calculator, a beacon for budget adjustment. This device considers variables like electricity costs, which can make or break your profitability, especially if you’re opting for hosted mining services. Imagine outsourcing your mining rig to a professional farm where experts handle the heavy lifting—your calculator becomes the crystal ball predicting whether that move will yield dividends or drain resources. Diversity in cryptocurrencies adds layers; while Bitcoin reigns supreme, Ethereum’s proof-of-stake transition and Dogecoin’s community-driven surges introduce unpredictable elements, urging miners to adapt their strategies dynamically.

Diving deeper, let’s explore how this calculator interfaces with the broader ecosystem. For Bitcoin aficionados, it’s a game-changer, factoring in the current hash rate and block rewards to project earnings. But what about Ethereum? As the second-largest cryptocurrency, ETH mining has shifted paradigms with its move to proof-of-stake, yet many still rely on rigs for other networks. The calculator’s versatility shines here, allowing users to input variables for multiple coins, including the meme-favorite Dogecoin, which thrives on accessibility and low entry barriers. This burst of options means your budget isn’t static; it’s a living entity, adjusted weekly or even daily based on exchange rates and mining farm efficiencies. Whether you’re a solo miner tinkering with a basic rig or managing a vast operation, the tool’s algorithms ensure you’re always one step ahead.

Now, consider the human element in this digital gold rush. Mining machines aren’t just hardware; they’re gateways to empowerment, sold by companies that also offer hosting solutions to democratize access. A typical mining rig, packed with powerful GPUs or ASICs, demands not only an initial outlay but ongoing tweaks to stay profitable amid rising difficulties.

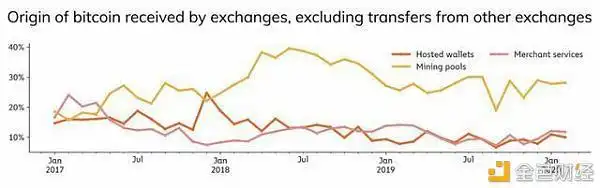

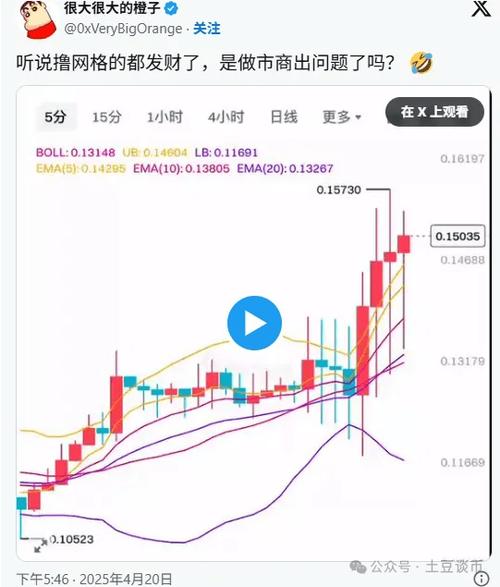

This is where burstiness in decision-making pays off—short, sharp adjustments versus long-term overhauls. For instance, if Dogecoin’s price surges unexpectedly, you might reallocate resources from Bitcoin mining, using the calculator to simulate outcomes and avoid costly missteps. Exchanges play a pivotal role too, as they reflect real-time values that feed into your profitability models, creating a symphony of data that keeps your finances harmonious.

Transitioning to practical applications, let’s not overlook the allure of mining farms. These sprawling operations, often hosting hundreds of machines, represent the pinnacle of scaled efficiency. Here, the calculator becomes a strategic ally, helping operators forecast energy consumption and maintenance costs against fluctuating Bitcoin prices. Rich in vocabulary and rhythm, think of it as a conductor orchestrating a diverse orchestra: Bitcoin’s steady beat, Ethereum’s innovative melody, and Dogecoin’s playful interjections. By analyzing trends, you can adjust your budget to accommodate upgrades or expansions, ensuring your investment in miners and rigs yields maximum returns. The unpredictability of crypto markets demands this level of preparedness, turning potential pitfalls into profitable opportunities.

Yet, amidst the excitement, pitfalls abound. Over-reliance on a single currency like Bitcoin can lead to vulnerability when difficulty levels soar, eroding profits faster than a sudden market dip. That’s why incorporating a mix—perhaps ETH for its smart contract capabilities or DOG for quick flips—enhances resilience. The calculator’s interface, often user-friendly and accessible via apps or web platforms, allows for layered analysis: from basic ROI projections to complex scenarios involving multiple variables. Its infectious appeal lies in empowering everyday users, not just corporate giants, to navigate the crypto landscape with confidence. Whether you’re purchasing a new miner or evaluating hosting options, this tool infuses your strategy with vivid clarity.

In conclusion, the Mining Profitability Calculator isn’t just a gadget; it’s a lifeline in the volatile world of cryptocurrency mining. By meticulously adjusting your budget in response to Bitcoin miner prices and network difficulty, you unlock a world of possibilities.

This approach extends to Ethereum’s evolving ecosystem and Dogecoin’s unpredictable rallies, ensuring a diverse and robust portfolio. As companies continue to sell and host mining machines, tools like these bridge the gap between aspiration and achievement, making every mined block a step toward financial sovereignty. Embrace the rhythm, the diversity, and the sheer thrill of it all—your crypto journey awaits.

One response to “Mining Profitability Calculator: Adjusting Your Budget According to Bitcoin Miner Prices and Difficulty”

This article offers a comprehensive insight into the intricacies of mining profitability, emphasizing the need for adaptable budgeting in response to fluctuating Bitcoin miner prices and difficulty levels. It effectively merges technical analysis with practical advice, making it a valuable resource for both novice and seasoned miners navigating the volatile cryptocurrency landscape.